Updates

- Code for DC has written a similar post for creating a non-profit in D.C.

The Goal

This post is an attempt to document the things that we’ve done at Free Law Project to get our official Federal and State non-profit status. This has been a grueling process for Brian and me but as we announced on Twitter, we now have it officially in hand, and likely in record time:

This isn't tax advice, but we're happy to announce the IRS approved our 501(c)(3) app, so donations are deductible! https://t.co/UjaBgSJorr

— Free Law Project (@FreeLawProject) October 10, 2014Check out this beauty! We’re finally the real deal.

All through the process, I wished there was something that had all the documentation of the process, so this is my attempt at such a post. I’m writing this after the fact, so I expect that I’ll munge a few details. If you catch me making a mistake, you can either edit this page yourself using my handy guide, or you can send me a note and I’ll update it.

Before We Begin

Three notes before we begin:

-

Our complete IRS packet is available. Please feel free to take a look.

-

The very best resource we found for this was a checklist from Public Counsel which reads like this blog post if it were written by qualified lawyers.

-

Nothing here, there, or anywhere is tax advice or legal advice or advice in any way, period. This is an overview of the process as we understand it. It might work for you, it might not. We’re not tax or IRS experts. Hell, I’m not even a lawyer.

The Overall Process

Here are the major steps for California and Federal recognition:

- Reserve the name of your organization with the Secretary of State

- Check for trademarks on your organization name

- Get an EIN from the IRS

- Get official with the Secretary of State of California

- Write Bylaws

- Write Articles of Incorporation

- Write Conflict of Interest and Ethics Policy

- Hold a meeting creating directors (and having them resign as incorporators, if necessary)

- Hold a meeting to ratify and adopt everything above

- File Statement of Information with Secretary of State

- Register with the California Attorney General’s registry of charitable trusts

- Get Federal recognition as a 501(c)(3)

- IRS-1023

- Your organization’s press coverage

- Your homepage

- Articles of Incorporation stamped by the State Secretary

- Phone a friend

- File for California tax exemption

- Get Municipal recognition

Reserve Your Name with the Secretary of State

This is an important step if you think somebody else might already have your name or if you think it might get scooped up before you finish your paperwork. This is your opportunity to say that your organization is named such-and-such and nobody else can have that name.

More information about this can be found on the Secretary of State’s website. The process involves downloading a form, filling it out, mailing it in, and then waiting for a reply. Once you get the reply, the name is yours for 60 days. This is probably also a good time to…

Check for Trademarks

If you think the name of your organization might be a trademark, you should check the USPTO’s trademark database to see if it is. If so, it’s probably wise to re-think the name of your organization. Naming your organization the Nike Charitable Trust probably won’t work out well for you.

Get an EIN

This is the official step that’s required to incorporate your organization and it’s a fairly easy one. Once this is done you’ll have an Employer Identification Number (EIN) from the IRS.

To do this, there is a multi-step form on the IRS website. Work your way through it, and if you come out the other side, you’ll quickly be the owner of a freshly minted EIN. Keep it private, as you would an SSN.

Get Official with California

At this point, you’ve moved past the easy stuff. It’s time for the weird and difficult paperwork.

Write Bylaws, Articles of Incorporation and Conflict of Interest and Ethics Policy

Writing these three items is a very persnickety part of the process. Each item must include certain phrases and failure to include those phrases will sink any attempt to get 501(c)(3) status down the road. The template we used for each of these was created by Public Counsel and can be downloaded from their website (Bylaws, Articles of Incorporation, Ethics Policy).

The best process we discovered for this was to very carefully work our way through each template and to update any section that needed it. The result clocks in at 25 pages for the Bylaws and Articles of Incorporation and ten pages for the Conflict of Interest and Ethics Policy.

Hold Some Meetings

OK, you’ve got your name, EIN, Bylaws, Articles of Incorporation and Conflict of Interest and Ethics Policy all ready. Now what? Well, now we enter the portion of the process that involves magic and wizardry. What we do now is we hold two meetings. Feel free to chant during these meetings if that helps them make sense.

The first meeting serves the purpose of creating directors and having them resign as incorporators, if necessary. To have this meeting, get all of your incorporators and directors together and decide to make it so. Have your secretary keep minutes from the meeting. You’ll need them for the 501(c)(3). Here are ours and here’s the template we used. You can see how this might feel a bit like voodoo magic if your board of directors is the same group of people as your incorporators (as in our case) — One minute they’re incorporators, the next they’re directors, and the people that authorized the switch are themselves.

The second meeting is where the real business goes down. Here you adopt all of the paperwork you created above, establish bank accounts, etc. Again, we used the templates from Public Counsel to keep minutes for this meeting. Check out our minutes for details and here’s a template. You’ll also see in our minutes a waiver of notice that waives the director’s normal requirement to tell people about the meeting in advance.

These two meetings can (and probably will) take place back to back, but they need to have separate minutes and need to be separate meetings. This is because until the board adopts themselves in the first meeting, they can’t very well do the things in the second meeting. Voodoo? Perhaps.

File Statement of Information with Secretary of State of California

Within 90 days of when you filed your original Articles of Incorporation, you need to take all of the above and send it into the secretary of state along with the SI-100 form.

If you do all of this well and properly, you’ll soon be registered with the State of California, but until you get your 501(c)(3) pushed through you can’t become an official California non-profit, so you’ll have to hold on for a bit for that piece of the puzzle. More on this in a moment.

Register with the California Attorney General

Another thing you’ve got to do, once you’ve got state recognition is to register with the California Attorney General. You have 30 days to do this from the moment when you first had assets as an organization. Be swift.

To do this, there are instructions on the Attorney General’s website, and there’s a PDF that you need to complete.

Get Federal Recognition

If you’ve come this far, you’re actually doing pretty well, but it’s time to find a good fortifying drink, because it’s about to get worse. Much worse. Our operating theory is that the IRS makes this hard because they simply don’t like giving tax exemptions — it’s antithetical to their whole raison d’être. But be that as it may, we must persevere if we’re going to make our organization a 501(c)(3).

So, what’s this process look like?

Well, there are really only two forms that you need to worry about. The first is the IRS-1023 and the second is the checklist for the IRS-1023. That should tell you something about the process you’re about to engage in: There’s a form for the form. Oh, and that’s not all: there’s a web form for the form for the form. Also, the IRS-1023 is an interactive PDF with parts that appear and disappear as you complete it. Also it crashes sometimes (save often!), can only be opened in Adobe Reader and there are three versions of the form and two different revisions. Dizzy yet?

Let’s see if I can simplify this:

- The IRS-1023 from December 2013 is currently the main form you want — it’s long and has a lot of questions. It is available in three forms: Interactive (recommended), Regular (no interactive stuff), and Accessible (even less interactive stuff?). You only seem to be able to get this form if you answer a bunch of questions aimed at prepping you for the process. Even then it gives you a zip containing the form, sigh.1

- The 1023 checklist must be included in your submission as a table of contents of sorts. The newest one I’ve found is from June 2006.

- There are copious resources online to help you complete these forms. The ones we used were form1023.org, the IRS’s own documentation, and the IRS’s FAQ for the form.

OK, you’ve got your forms, let’s talk a bit about the packet you’re going to send to the IRS. The best place to begin understanding the packet is by looking at the checklist we just downloaded. In addition to the items mentioned above, it also requests a number of new items we haven’t seen before. Most of these won’t be necessary for most non-profits, but one is new and worth mentioning: the Expedite Request.

Getting Expedited

As we’ve come to understand it, there are essentially three queues your paperwork can fall into at the IRS:

- The urgent queue (30 days?)

- The normal queue (90 days?) and

- The troublemaker queue (> 90 days / Never)

Your goal is to fall into one of the first two queues. If you fall into the third, it’s possible you’ll never come out the other side. Seriously.

If you want to fall into the first queue, you need to complete an Expedite Request. These are actually pretty straightforward, but you need to qualify. You can see an example of our Expedite Request in our 1023 submission, but basically, you need to state specific harm that will occur if your organization doesn’t get swift 501(c)(3) processing. There are guides about this on the IRS website that we used (successfully, we believe).

Getting faster processing is great but it’s not always possible. Failing that, the thing to do is make sure that you don’t fall into the third queue.

I think the important parts of this are:

- Carefully follow the instructions provided by the IRS for the 1023.

- Make sure that your articles of incorporation contain the proper purpose and dissolution clauses (they will if you use the templates).

- Check the top ten list provided by the IRS for speeding up the process.

- Do not mention any of cursed words on the IRS’s list to “Be On the Look Out” for (So-called BOLO words).

The list is apparently no longer in use due to the furor it caused, but it’s still instructive to know what was on it. For example, in our case “Open Source” was on the list, so despite working in the open (something we believe contributes to our educational purpose), we had to be very careful never to mention that in our mission or anywhere else just to ensure there were no misunderstandings.

Once you’ve got your Expedite Request completed, it’s time to work on the 1023 itself. This is a long and arduous process that is too detailed to get into. Be careful, be thorough, follow the guides, and get help from a friend or lawyer. We found it to be incredibly useful to get somebody with experience to carefully look at our paperwork.

Other Things We Sent the IRS

In addition to the items mentioned above, we also included printed copies of a partnership agreement we have with Princeton for the hosting of RECAP, a printed selection of press, and printed copies of our homepages (RECAP, CourtListner, Free Law Project).

The goal of these enclosures was mostly to keep the IRS reviewer from touching their computer, but also to keep their life as simple as possible. Like any application, you want to control the information that is provided to the reviewer. Just like you wouldn’t want your next boss seeing your Facebook profile, you don’t want the IRS reviewer looking up your organization’s website. There’s likely nothing bad for them to see, but you want to keep things as simple as possible. Maybe, we reason, if we provide a printed copy of our homepage they won’t bother booting up their computer. Perhaps.

Remarks on Formatting, Etc.

Sadly, like filing with the Supreme Court, completing your 1023 involves a few formatting and clerical details that we must attend to. First you must be sure to put your name and EIN on the top of every page. This is suprisingly difficult since many of the pages are PDFs you don’t control, but you can pull it off if you try by feeding your printed documents through the printer twice. The first time, you print the regular stuff, the second time you print a blank page over and over that contains your EIN and organization name in the header. Fun.

The second thing to attend to is the ordering of the documents themselves. This is the order of our 1023, and from what we can tell, you really shouldn’t do anything much different:

- 1023 Checklist

- Request for Expedited Processing

- List of Enclosures

- The 1023 itself

- Articles of Incorporation

- Bylaws

- Supplemental answers to 1023 questions

- Conflict of Interest and Ethics Policy

- Minutes adopting Conflict of Interest and Ethics Policy (remember when we made these?)

- A partnership agreement we have with Princeton

- Our selection of press coverage

- Printed copies of our homepages

- IRS Form SS-4 indicating our EIN

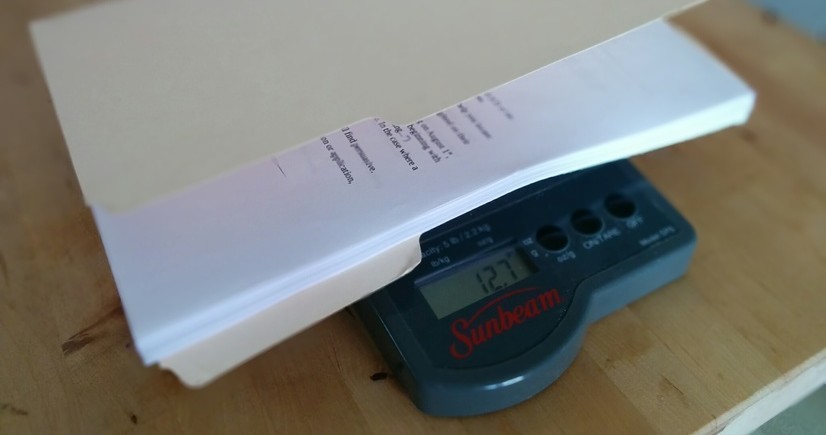

In total: 83 pages of delightful paperwork and one check for $850.

File California Tax Exemption Forms

If all goes well, you’ll soon hear back from the IRS and be granted your Federal recognition as a 501(c)(3). Congratulations on a hard-won victory.

Now that that’s in place, it’s time to switch back to California and wrap things up with them. To do this you need to complete form 3500A (information / download).

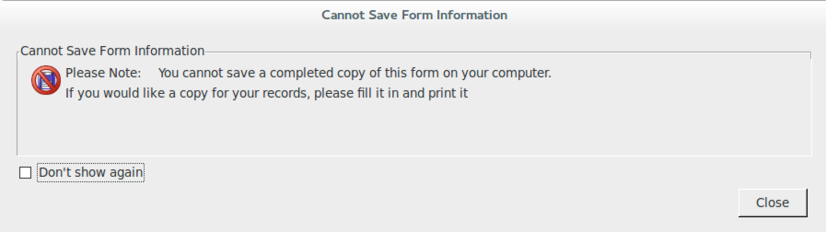

Don’t try to save this form. You can’t:

Instead, fill it out, print it, and mail it in along with a copy of your Federal Recognition. If you can print to PDF, that might save your work.

Get Municipal Recognition

The final step of this process for us, though it might come much earlier for you, was to get in touch with the city where we incorporated and to tell them that we exist. We tried to do this early on and had the city staff member in charge of business licenses tell us to come back once we had 501(c)(3) recognition. In the city we selected non-profits are exempt from city business license fees, so that may be why they were so lax about the timing of this paperwork. You may find in your city that they want you to have a business license and pay related fees while you’re waiting on 501(c)(3) status (and sometimes even after).

Wrapping Up

All in all, that’s the basic process of creating a non-profit and getting tax exemption from the feds, the state and your city. Most of this went pretty smoothly, but the most difficult part was by far the IRS-1023, and even that we were able to get our results back in about 30 days. This feels like something of a miracle, but it took us over a year to get all the paperwork completed and submitted.

In the end I liken the process to an incantation of a magic spell: Done correctly, you wind up with a massive pile of paperwork that magically looks like a bad-ass application for tax-exempt status that washes over anybody that looks at it, convincing him or her that your organization is charitable and deserves tax exemption in a forthright manner.

Done incorrectly, you enter a hole of despair, despondency and, worse, taxation.

-

Yes, PDFs are generally compressed internally. ↩

I love getting feedback and comments. Make my day by making a comment.